As a contrasting example, in the United Kingdom, the surrender value of a with-profits policy is increased by a bonus, which also serves the purpose of distributing profits. Life insurance dividends and bonuses, while typical of mutual insurance, are also paid by some joint stock insurers. Janis Samples receives forty of these newly issued shares (4 percent of one thousand) so that her holdings have grown to 1,040 shares. After this stock dividend, she still owns 10 percent (1,040/10,400) of the outstanding stock of Red Company and it still reports net assets of $5 million.

No change to the company’s assets occurred; however, the potential subsequent increase in market value of the company’s stock will increase the investor’s perception of the value of the company. The existence of a cumulative preferred stock dividend in arrears is information that must be disclosed in financial statements. Only dividends that have been formally declared by the board of directors are recorded as liabilities.

What Is a Dividend?

Additionally, when a company increases the amount of its normal dividend, then there is an expectation that this will be a sustained increase. Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. Dividends Payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are generally fulfilled within one year. If a company’s board of directors decides to issue an annual 5% dividend per share, and the company’s shares are worth $100, the dividend is $5. A high-value dividend declaration can indicate that the company is doing well and has generated good profits. But it can also indicate that the company does not have suitable projects to generate better returns in the future.

We will now look at some examples of how dividends are split when both common and preferred shares are outstanding and a lump sum dividend is declared. And as with debiting the retained earnings account, what are payroll taxes you’ll credit the total declared dividend value. Cash dividends are paid out of a company’s retained earnings, the accumulated profits that are kept rather than distributed to shareholders.

- Although cash dividends are common, dividends can also be issued as shares of stock.

- Investors can view the total amount of dividends paid for the reporting period in the financing section of the statement of cash flows.

- As well, a company may not want to pay the maximum dividend it is legally entitled to because it does not want to create unrealistic expectations among shareholders for future dividends.

- This differentiates it from a payment for a service to a third-party vendor, which would be considered a company expense.

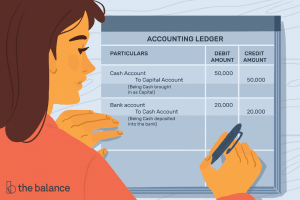

Many corporations distribute cash dividends after a formal declaration is passed by the board of directors. Journal entries are required on both the date of declaration and the date of payment. The date of record and the ex-dividend date are important in identifying the owners entitled to receive the dividend but no transaction occurs.

Having the preference does not guarantee preferred stockholders a dividend, it just puts them first in line if a dividend is paid. Preferred stock usually specifies a dividend percentage or a flat dollar amount. For example, preferred stock with a $100 par value has a 5% or $5 dividend rate.

On this date, the value of the dividend to be paid or distributed is deducted from retained earnings. The date of payment or distribution is when the dividend is given to the stockholders of record. Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits.

Forms of payment

Cash flow planning is important to the management of a business, and although the company may have sufficient retained earnings to declare a dividend, it may not have the cash readily available. Remember that the retained earnings balance does not equal cash, as companies will invest in many different types of assets. As well, a company may not want to pay the maximum dividend it is legally entitled to because it does not want to create unrealistic expectations among shareholders for future dividends.

1 Warren Buffett Stock to Buy Hand Over Fist Right Now — The Motley Fool

1 Warren Buffett Stock to Buy Hand Over Fist Right Now.

Posted: Mon, 31 Jul 2023 12:45:00 GMT [source]

Once you have the total dividends, converting that to per-share is a matter of dividing it by shares outstanding, also found in the annual report. The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. In some cases, it may be difficult to distinguish between a share split and a large share dividend. For example, the effects of a 100% share dividend and a 2-for-1 share split are essentially the same.

How to Calculate Dividends (With or Without a Balance Sheet)

Don’t worry, your balance sheet will still balance since there will be offsetting changes. Since shares of some companies can change hands quickly, the date of record marks a point in time to determine which individuals will receive the dividends. Large stock dividends, of more than 20% or 25%, could also be considered to be effectively a stock split. A stock-investing fund pays dividends from the earnings received from the many stocks held in its portfolio or by selling a certain share of stocks and distributing capital gains.

- The investor’s financial position has not improved; she has gained nothing as a result of this stock dividend.

- Payments can be received as cash or as reinvestment into shares of company stock.

- Miller and Modigliani thus conclude that dividends are irrelevant, and investors shouldn’t care about the firm’s dividend policy because they can create their own synthetically.

These can be key signals in the maturity of your business and optimism of the business owners or directors. If you don’t need to report in GAAP, you probably have a simpler business structure and fewer shareholders. Amy is a Certified Public Accountant (CPA), having worked in the accounting industry for 14 years.

Enter a Cash Receipt for the Patronage Dividend

They are a distribution of the net income of a company and are not a cost of business operations. A company currently has 100,000 shares outstanding that are trading at $5.25 per share. The company decides to declare a 5% share dividend, which means an additional 5,000 shares will be issued to existing shareholders (). Immediately prior to the dividend declaration, the implied value of the company is $525,000 (). Because a share dividend does not have any effect on the assets or liabilities of the company, we would expect the total value of the company to remain the same after the dividend.

Brown-Forman Stockholders Elect Directors and Board Approves … — Brown-Forman Corporation

Brown-Forman Stockholders Elect Directors and Board Approves ….

Posted: Thu, 27 Jul 2023 20:07:51 GMT [source]

This will reduce the number of outstanding shares by a certain proportion. This type of transaction is usually motivated by the need to increase the market price of a share. If preferred dividends are declared, the accounting is similar to the accounting of common share dividends.

Financial and Managerial Accounting

This type of dividends increases the number of shares outstanding by giving new shares to shareholders. In accounting, dividends often refers to the cash dividends that a corporation pays to its stockholders (or shareholders). For a dividend to be paid, the corporation’s board of directors must formally approve/declare the dividend. Hence, the board of directors may decide that a dividend will not be declared.

This means all preferred stockholders will receive a $5 per share dividend before any dividend is paid to common stockholders. Some shares of preferred stock have special dividend features such as cumulative dividend or participating dividend. A dividend is a distribution of profits by a corporation to its shareholders.[1] When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital.

Thus, four hundred new shares are conveyed to the ownership as a whole (4 percent of ten thousand) which raises the total number of outstanding shares to 10,400. A traditional stock split occurs when a company’s board of directors issue new shares to existing shareholders in place of the old shares by increasing the number of shares and reducing the par value of each share. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder.

For example, cash dividend payments usually drop after a stock dividend but not always in proportion to the change in the number of outstanding shares. An owner might hold one hundred shares of common stock in a corporation that has paid $1 per share as an annual cash dividend over the past few years (a total of $100 per year). The board of directors might then choose to reduce the annual cash dividend to only $0.60 per share so that future payments go up to $120 per year (two hundred shares × $0.60 each).

Managers of corporations have several types of distributions they can make to the shareholders. A share buyback is when a company uses cash on the balance sheet to repurchase shares in the open market. The board of directors can choose to issue dividends over various time frames and with different payout rates. Dividends can be paid at a scheduled frequency, such as monthly, quarterly, or annually. For example, Walmart Inc. (WMT) and Unilever (UL) make regular quarterly dividend payments.